Cencora Acquires Retina Consultants of America for $4.6b (15x to 23x EBITDA)

- Will Hamilton

- Nov 8, 2024

- 2 min read

Updated: Mar 19

Healthcare drug distributor Cencora has purchased Retina Consultant of America for $4.6 billion. RCA is (by far) the largest MSO in the retina space, representing a significant distribution channel for macular degeneration medications. The transaction marks another in a number of specialty physician group acquisitions by the trio of large healthcare distributors - McKesson, Cardinal Health, and Cencora. Historically, these acquisitions have been concentrated in medical oncology (chemotherapy drugs), but have recently diversified into the GI and retina specialties. According to Cencora's CEO:

“The acquisition of RCA will allow Cencora to broaden our relationships with community providers in a high growth segment and build on our leadership in specialty. With a compelling value proposition for physicians, an impressive leadership team and strong clinical research capabilities, RCA is well-positioned at the forefront of retinal care. We intend to use our leading operational infrastructure to help RCA enhance the provider experience, drive innovative new research and create better outcomes for patients. Following our recent investment in OneOncology, the addition of RCA will allow us to expand our MSO solutions and drive differentiated value across the healthcare system for manufacturers, providers and patients.”

RCA was formed in March 2020 with a $350 million investment by Webster Equity Partners. RCA's affiliated practices, physicians and management retain a minority stake, with Cencora holding about 85% of the business on closing.

Ophthalmology M&A Environment

Retina specialist and general ophthalmology announced M&A volume have both declined significantly over the past several quarters, as the specialty enters a more mature stage amid some pessimism around demand for PE-backed physician group exits.

Specifically within retina, the decline may be in large part due to a slowdown in investment by RCA as it was prepared for sale. According to our database, RCA is responsible for 50% of the retina M&A deals announced since 2019.

Physician Specialist EBITDA Multiples

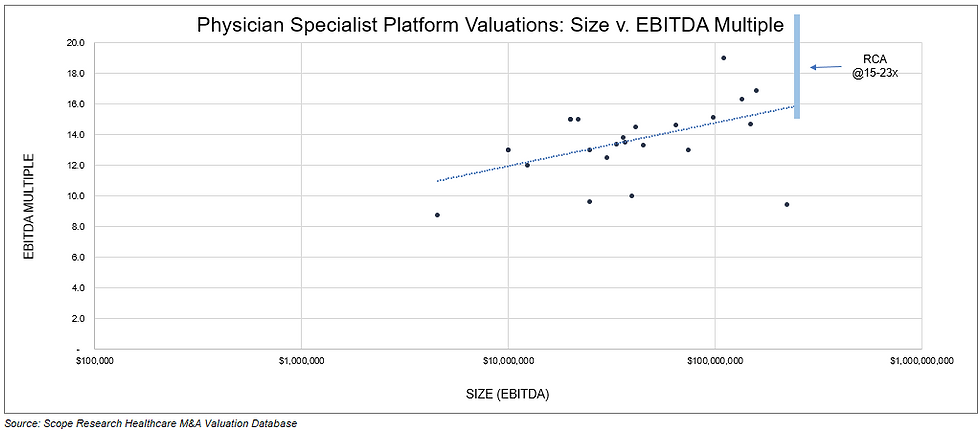

According to Axios reporting, RCA was marketed off between $200 million and $300 million in EBITDA, implying a multiple in the range of 15x to 23x. The implied range starts in line with historical comps and extends to above the top of the historical range for office-based physician specialist platforms.

About Scope Research

The Scope Research Healthcare M&A Valuation Database currently has financial details for 217 physician practice deals going back to 2010, 136 of which include reported EBITDA multiples. The physician practice data can be purchased individually, while our affordable annual subscriptions provide access to all of our healthcare M&A databases and segments, updated continuously.

Don't hesitate to reach out to Will Hamilton at will@scoperesearch.co with questions about your specific situation.